Buyer vs. Seller: The College Edition

May 01, 2025

Not All Colleges Play the Same Game

Some colleges offer generous aid to families making $200K+. Others expect you to pay full price—no matter your circumstances. The difference could be six figures. Here’s how to spot the schools that are actually worth your money.

TL;DR

Not all colleges are priced the same way. “Buyer” schools often discount tuition or offer merit aid, while “seller” schools rarely do. Knowing the difference could save your family tens of thousands—and we can help you figure out which is which. Book a free call to learn more.

Ok, families of juniors (and sophomores, if you're right on track)—you're narrowing down your college list. Believe it or not, the Common App opens August 1, and application season is officially creeping in. Your student is hearing all the schools their friends are applying to, talking to their counselor, and prepping for SATs and AP exams.

And now you’re hearing this weird phrase pop up: “Buyers vs. Sellers.”

Wait a minute—aren’t colleges nonprofits? Why are we talking like this is the stock market or Zillow?

(Dad joke alert: “Next up on College HGTV, watch as families try to ‘flip’ their student into a Top 20 without blowing the budget!”)

But seriously, the buyer vs. seller concept isn’t just financial jargon—it’s a critical way to understand how much college could cost your family.

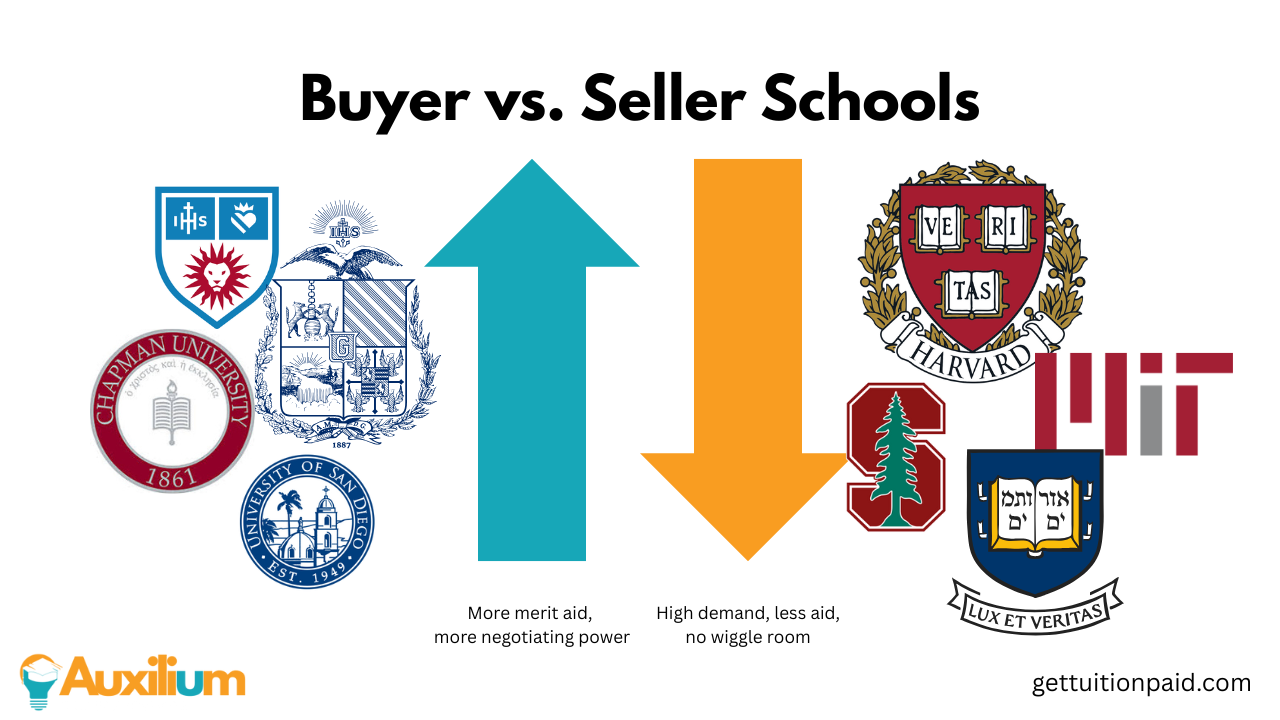

🎓 So What Is a Buyer vs. Seller School?

Think of it like this:

- Seller school: Like trying to get your name on the list for a limited-edition Rolex. You want it—they don’t need to sell it to you. Prestige and exclusivity mean you have no leverage.

- Buyer school: Actively competing for students like yours with scholarships, merit aid, and flexibility.

These aren’t official labels—but they’re very real when it comes to how colleges manage money and admissions.

📊 The Secret Word: Yield

Colleges track something called yield, which is the % of students who accept an offer. High yield? They don't need to offer aid. Low yield? They roll out the red carpet—often with merit-based financial aid.

🧠 Let’s Break It Down

Seller Schools

- Examples: Ivy League, Stanford, MIT, top UCs

- What You Get:

- Prestige? Absolutely.

- Scholarships? Rare.

- Negotiation? Nope.

- Aid? Only if you demonstrate financial need.

These schools are like luxury collectibles—exclusive, sought-after, and full price unless you’ve got serious need.

Buyer Schools

- Examples: Many private colleges, smaller liberal arts schools, regional public universities

- What You Get:

- Higher chance of acceptance

- Merit aid, even without financial need

- More negotiation power

- Often huge discounts off sticker price

They may not have the same name recognition, but the value is often unbeatable—and your student might actually be a top recruit.

💸 Why This Matters

If your college list is packed with seller schools, be ready: you could be looking at a total cost of attendance of up to $99,000 per year. Blend in buyer schools and you may cut that by half—or more.

Your student gets choices. You keep your retirement intact. Win-win.

🧭 Want Help With This?

We’ve helped thousands of families save millions over the last 30+ years. We’ll run a side-by-side comparison of the schools on your list and show you which ones are buyers and which are sellers.

➡️ Book a free call at www.gettuitionpaid.com

Don’t go into college season blind. Let’s find the schools that want your student—and your wallet—to stick around.